Manufacturer IPG Broadens Product Capabilities As Consumers View “Beauty In A Much More Holistic Way”

After working at companies like Bristol Myers Squibb and Bath & Body Works, where they met, Bob Goehrke and Tish Poling decided they wanted a change of scenery, literally and figuratively. They moved out of corporate jobs and into the Salt Lake City area to start International Products Group. At first, the beauty manufacturer served established powerhouse clients, but it’s since developed a specialty in catering to emerging indie brands. IPG’s annual capacity surpasses 150 million units, and products it produces populate shelves at chains the likes of Target, Walmart, CVS and Walgreens.

“We have this beautiful environment here that’s very synonymous with health and wellness,” says Goehrke. “We founded IPG almost 20 years ago with the vision of creating high-performance natural beauty products. Fast forward, this whole founder-led and influencer brand approach, which wasn’t around 20 years ago, has really become our niche and our forte.” For founder-led and influencer brands, it can orchestrate everything from formulation to logistics. “Think of us like the general contractor,” says Goehrke. “You want to build a house and you have a vision for what that house will look like, we pull in all the experts, and we handle it soup to nuts.”

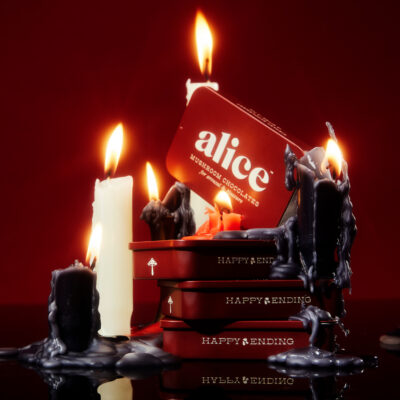

With the growth of indie beauty, a segment in the United States market research firm NIQ estimates generated $30.5 billion revenues in the year ended June 17, up 15.7% from the prior year on a dollar basis, IPG’s business has accelerated. Last year, it landed at No. 60 on magazine Inc.’s list of fastest growing companies for the rocky mountain region by registering 60% growth over a two-year period. A big sales driver for IPG now is ingestible merchandise, a product category beauty brands are delving into as consumers incorporate beauty and wellness into their view of health.

Beauty Independent chatted with married couple Goehrke and Poling about ingestible products, private equity’s involvement in beauty manufacturing, the heightened costs of making beauty products, demand for sustainability, artificial intelligence, suggestions for brands just getting underway, the current state of the beauty industry and where they believe it will be in the future.

How did the company come about?

Goehrke: Tish and I came out of corporate America working a big Fortune 500 beauty companies. We met at Bath & Body Works. We were senior executives there. Twenty years ago, the market was not looking for authentically natural products. We said, there’s got to be a better way, and we said let’s redefine our personal lifestyles. Tish and I decided to move to Salt Lake City. We have this beautiful environment here that’s very synonymous with health and wellness.

We founded IPG almost 20 years ago with the vision of creating high-performance natural beauty products. Fast forward, this whole founder-led and influencer brand approach, which wasn’t around 20 years ago, has really become our niche and our forte.

How different is IPG today versus when you started it?

Poling: We were more of an incubator and used specifically one particular factory to make all of our products and that quickly became a big bottleneck. We had 40 clients—Walmart, Target, all the way up to highly prestige products—and everything was going through one factory. We decided we needed to own our formulas. We opened our own lab with our own chemists, and we have a factory list now of six different factories.

We have relationships with these factories now that go back 20 years, 18 years, 15 years. It is a true partnership. So, it’s changed pretty drastically from being dependent on a chemist, lab and factory to being able to pick and choose where we bring formulas. That has been a big change for us.

Goehrke: We can make anything in topical personal care with the exception of color cosmetics. With COVID, we extended into inner health ingestibles. We do the gummy line for a major retailer and produce liquid collagen and lactation bars. So, we’re much more multidimensional. We’ve become very nimble. Our capacity is exponentially greater than it was 20 years ago, and we’re really thinking more beyond beauty into overall wellness.

Who’s a prototypical client, and how does that client work with you?

Goehrke: That’s evolved as well because the market has evolved. When we started, we were working with Walmart, CVS and Target. That’s a different type of deliverable than what we have now with the advent of founder-led and influencer-led brands. Instagram wasn’t around 20 years ago. Some of our clients have 40 million followers on Instagram.

We like to say we’re the wind beneath the wings behind the scenes for our clients. It is a complete concierge turnkey approach, where we start at the beginning with innovation and formulation right down to packaging, manufacturing, regulatory and 3PL. When we have an influencer client or an indie brand come to us, they say, “I have financing, and I have a vision, but I don’t know how to enact it.” We say, “We got this, we do everything.”

Poling: One thing I would add is we look at things that are not me too. I mean the world doesn’t need another shampoo. If we’re going to make a product for somebody, it has to be demonstratively different, and it has to be selfie ready because I would say 90% of our clients are in Sephora, and they want that Instagram shot. We take the approach of it has to be an award winner. We look at the white space before we even start all the way through to commercializing.

What’s an average production run at IPG?

Goehrke: A lot of our competitors look at average runs. We look at length of relationship. Most of our customers have been with that anywhere from five to 15 years, and some of those we will run 5,000 or 10,000 units at a clip. Some of our bigger customers started at 5,000, and now we’re doing millions of units with those customers. We treat the 10,000 run no different than we treat the half-a-million unit run because it’s all about that relationship, but I would say the typical run is 25,000.

Poling: If it’s a brand-new product, we understand they want to tiptoe out there with it. So, we’ll run 5,000 or 10,000 pieces. Then, it’s usually a very quick follow-up with a much larger run. On price point, I’m going to buck the system and give you some secrets. I could make the best serum on the market— peptides, ceramides, vitamins, retinol—and it’s not going to cost over $4 on our end, very healthy margins for our customers, yet the performance is paramount.

How have the unit economics of beauty manufacturing changed since you started?

Goehrke: It’s not a secret that inflation is a big market dynamic, but no one ever wants to get a price increase. As a supplier and vendor partner, we need to manage costs. As we’ve gotten bigger, we’re able to buy in greater quantities and manage costs.

Still, the costs have gone up. For the first time in our 20-year history, we’ve had to take selective price increases, but the margins have been squeezed all around. Most of the big retailers won’t even accept large price increases, and it becomes that problem is passed down the supply chain.

Poling: Gas prices, shipping, labor and raw materials have gone through the roof and labor. In raw materials, some of the high-end actives have increased pretty significantly, but, for the most part, we’re able to keep that stable. It’s those things that are driving crazy costs for our customers.

Tell us more about labor costs in beauty manufacturing.

Poling: We have one factory in Southern California, so we have to deal with California prices. We have three factories in Texas, one in New Mexico, one in Tennessee. California is the most expensive. We probably started 20 years ago at $6 or $7 an hour for labor, and now it’s between $20 and $25 an hour for a line worker in California. That makes it very difficult to own a factory in California.

Tennessee is much less expensive right now. I think we’re paying somewhere in the $12 to $13 range. So, most of our large runs are done in Texas, New Mexico and Nashville. In California, it is our boutique factory. A lot of our high-end clinical skincare is done there with intricate packaging that a machine can’t twist on, so it’s all hand done. I save our formulas in beautiful packaging that are going to be very labor intensive for that facility.

We’ve seen investment coming into beauty manufacturing from private equity in particular. What’s happening from your perspective?

Goehrke: What you see is a consolidation of a lot of the manufacturers. KDC is an example. Where the white space is for companies like IPG is that as we remain mid-sized or boutique, and we’re able to supply a different type of service.

There’s room for everyone. The big factories can certainly crank out those million-unit Walmart runs very well and very cost effectively. We have decided to focus on the other end of the market, which is these founder-led indie and influencer brands, where we can supply more of a turnkey concierge service and really hold their hand.

How’s business been?

Goehrke: We had a record year last year. We’re privately held, and Tish and I are the sole owners. We don’t have any outside investment. We’re having a very solid year this year. With all the uncertainty in the world with wars, inflation and interest rates, it seems like the fourth quarter has slowed a bit for a lot of people.

Our projections for next year are terrific. We have a lot of new business coming in. A lot of people in 2023 for economic reasons have pushed back business into 2024, and that’s fine. The nice thing about being privately held is we’re not beholden to shareholders, and we can manage for the long term.

What’s driving your projection for next year?

Goehrke: What drives our new business is innovation, creating new types of products, and the influx of more and more influencers, celebrities and indie brands getting into the game. Everyone wants to build a brand. Typically, the long-term goal is that you build a brand and these big strategics will buy you. We help those brands get from A to B to Z. And people are looking at beauty in a much more holistic way. That’s exactly in our sweet spot.

What are you seeing brands that are at the leading edge of wellness do?

Poling: Gummies have taken over as the No. 1 preferred avenue to take supplements, and it is just gummy crazy. If you go to a Walmart or CVS, you’ll see aisles and aisles of gummies. What our customers are looking to do is, how can they extend their beautiful products into something outside of the beauty world? It’s collagen, probiotics, teas like ceremonial-grade green tea.

We have a couple of the largest mommy and baby companies in our portfolio, and they’re looking for lactation cookies and bars, and things that have been Etsy products or that you would find at a fair or market, but aren’t widespread.

People are buying all sorts of products that are inner health, outer beauty. So, probiotics with an acne line is very, very exciting to some of our clients right now, hair, skin and nail gummies, immunity gummies, adaptogens are huge, and [supplements] for a menopause line. That’s what we’re working on now, and we’re inundated on that side of the business.

There’s been growth in masstige skincare, and this year saw the sale of Naturium in that space. Do you believe that will continue? Where is skincare heading?

Poling: I still think people go to Sephora and pick up a product and say, “This is the good stuff.” Naturium is taking the path that The Ordinary took, and they’re almost in a very quiet manner calling out, this is really how much this costs.

But, pulling someone out of the air, Shani Darden can get online and really educate you about skin. Rachel and Tish maybe can’t go to LA and get a facial from her, but we can buy her products, and she’s going to educate us on how to do it in our own bathrooms. I think people are willing to pay more for these products with cult followings that work.

If you had the opportunity to reinvent The Body Shop for today’s consumers, what would it look like?

Poling: It would not be synthetic fragrance. We work a lot with all of the beautiful fragrance houses in the world—Firmenich, Givaudan—but I haven’t put synthetic fragrance in a product of ours, and we do in the hundreds of products every year. The staples of Bath & Body Works and The Body Shop are just synthetic fragrance. I would make it all 100% natural and essential oil fragrance much like Neal’s Yard in the U.K. I also think right next to that product could be problem-benefit and wellness products. It would be a little dreamland all put together.

Goehrke: Tish was in charge of all the education of the 50,000 store associates at Bath & Body Works. I think The Body Shop devolved into more of a self-select environment, but people want education. If you’re going to pay $50, $60, $70 for a product, you want to understand how to use it and what the benefits are. To go into a store and just walk around aimlessly is a tough scenario these days.

Poling: When I was at Bath & Body Works, there’d be a new fragrance, and they’d give you a hand massage with it. The conversion was eight out of 10 would buy it. We spent millions of dollars on philosophy that people like to be touched in a way that’s very approachable. We also did a little massage on your back. It was this oasis in the mall where you could go to the sink and use the scrub or get someone to do a massage on your hand or back, and you’d walk out with $50 of products in your bag. That doesn’t happen anymore.

When I was growing up, the pharmacist was a real pharmacist, and he came out from behind the counter and helped you with chickenpox, eczema and cold symptoms and flu. We’re seeing that pop up all over the world where people may not be going to Walmart where nobody helps you to get your prescription. You’re going to C.O. Bigelow where there is service. We have the ability to pick and choose where we shop, and people want that type of service again. So, I think, for The Body Shop, it should be very service-oriented.

What do you think really moves the needle with beauty consumers for sustainability?

Poling: They want vegan. They’ll allow honey, but nothing else. Waste is on the mind of the 20-year-old, and when it comes down to true sustainability, they’re looking for no waste. I mean water that comes in a milk carton that they’ll buy that all day long, even if it costs more. They won’t ask for the plastic bag at Target.

It’s a generational shift, and I think the next generation is saying, “Give me a 64-oz. bag of Honest Company body wash with a big fat spout, I’ll pay for it. I don’t want to use five bottles even if it’s recyclable.”

We have amazing people in their twenties working for us. Plastic is just a big fat no-no to them, and they want as natural as possible. They are so educated because they can look up every ingredient on their phone, and they look up what goes into landfills and what’s going on with refillable packaging. So, it’s glass or PCR.

This year has been riddled with examples of indie beauty brands shutting down. Do you think we there will continue to be a raft of closures?

Poling: It’s really scary. I think there will be closures, and I think much like 2009 and 2010, you’re going to see manufacturers close. You’re going to see the little tiny guy not make it. I think those who connect with their customers the best will win. We know when it’s phony, and you’re just posting to post something and keep it in your Instagram feed versus that you care about your brand and the customer.

Some launches are going to have to be lower price point. They’re going to have to come off that $90 serum. It’s not what’s going on in the world right now. Who wants to pay $90 for a serum? So, the strategy is going to change drastically, and I think we will lose some smaller brands and smaller manufacturers who just can’t make it.

Is there something that brand founders don’t get about the way that the manufacturing business works that could help them in the long term?

Poling: Think about what they want before they make that first phone call. Some people just are led down a road that it’s almost like, if I had a magic wand, this isn’t really what I wanted. If they want to build a brand, then reality needs to set in, and they really think about what it is they want to launch.

I think the biggest mistake is they launch too many products. You and I don’t buy five products from the same company. We cherry-pick this serum and that moisturizer and this cleanser. What Summer Fridays did by tiptoeing out with just Jet Lag Mask for six months is the right thing to do, and I think that is exactly what people should do moving forward.

Goehrke: The key to working with a manufacturer is communication, no different than any relationship in life. We advocate face-to-face communication. Emails and texting are OK, but we invite our customers to our Salt Lake City headquarters to meet them in person, and we’ll fly all around the country.

There’s a lot of talk about how artificial intelligence will impact beauty manufacturing. What do you think about its impact?

Goehrke: I’ve been in beauty now 40 years. It’s a person-to-person, high-touch business. I don’t want to sound old school. I don’t see AI as a threat or as a major force, certainly not in my lifetime.

Poling: I’m sure AI could come up with a formulation, but I think it would be a lot of repeat, and we’re all about custom at this point. People come to us for custom formulation.

IPG has been in business for almost 20 years. If you had to look ahead 20 years, where do you think the beauty industry will be then?

Poling: Cleaner ingredients that perform. I know that some people will say people just want clinical. However, every time I formulate something that is super clean, that has an amazing experience and performs, they buy it every time. So, it may not be the No. 1 reason to buy, but it’s definitely two or three.

There are so many ingredients still that should not be in skincare. There are just beautiful alternatives that, if you knew what you were doing on the formulation bench, you would never use those. It’s forcing the fragrance companies to get rid of phthalates, and it’s forcing the packaging companies to come up with PCR. There’s going to be pressure on industries that have been getting a pass.

Goehrke: Greater customization of products, and maybe this is where AI comes into play. The consumer base is becoming less homogenous than it was years ago, and people want products that are made specifically for them. There will be a technological breakthrough that will allow manufacturers and brands to really create products that are more specific for individual customers. I don’t know what that answer is exactly right now, but 20 years from now, people smarter than us will probably figure that out.

Poling: It will be more multicultural, too. In the last five years, multicultural beauty has seen an explosion of opportunity, and we’re really proud that we have five brands in the Sephora that are Black-owned businesses. I think men’s will finally get its day in the sun. Men are finally understanding that taking care of their skin is important. I think they will finally start caring about skincare and haircare as well.