Bridge Mentorship Helps Brands Understand The Cautious Mindset Of Today’s CPG Investors

Investors have shifted from focusing on growth to focusing on profitability and brands that can prove their potential, but many beauty entrepreneurs still haven’t adjusted to the practical mindset.

“Today, everybody wants to grow faster than they probably naturally can,” says Rich Gersten, co-founder and managing partner of True Beauty Ventures (TBV) during a Beauty Independent In Conversation webinar last week. “They think that’s going to help them secure investment, drive valuations higher and minimize dilution and all those things, but it takes a while to build a brand and that real pop may come much later in your existence. So, being patient and realistic is really important.”

Cristina Nuñez, co-founder and general partner at TBV chimed in, “As an investor, we’re trying to figure out what the proof points are that will show that this business can go from where it is today to true scale and to be something that could potentially grow and exit.”

The webinar recapped lessons from the fourth cohort of Bridge Mentorship, a six-month program designed by Beauty Independent and TBV, a beauty and wellness- focused investment firm that counts BeautyStat, Crown Affair, K18, Caliray, Vacation and Dieux as portfolio companies, to ready emerging beauty and wellness brands for fundraising. To be eligible for the program, applicants must lead brands based in North America at least six months old and generating annual sales of $250,000 or above. Applications for the program’s first cohort of 2024 opened on Nov. 29 and will close Dec. 13. Three brands selected for the cohort will be revealed in January.

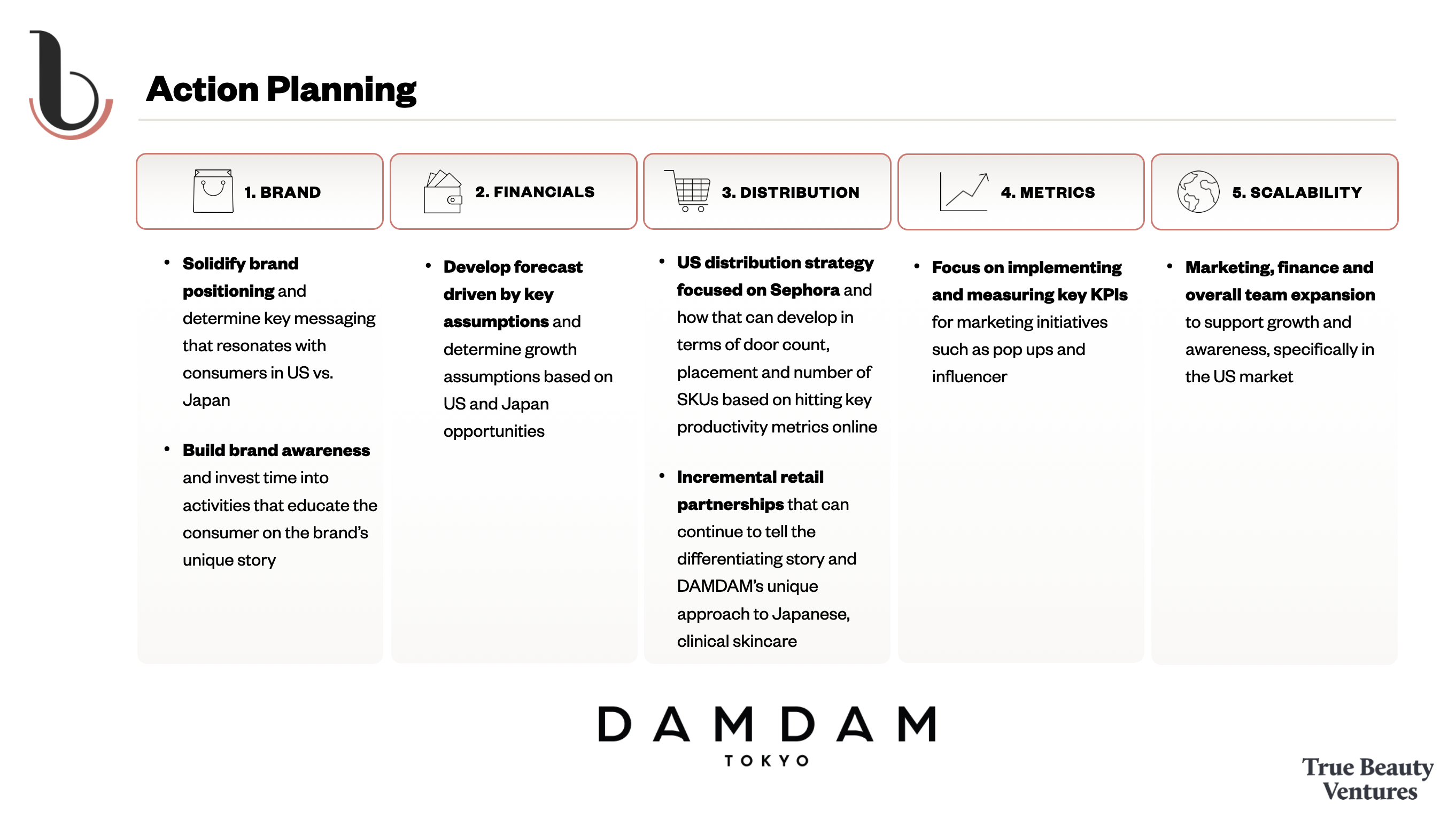

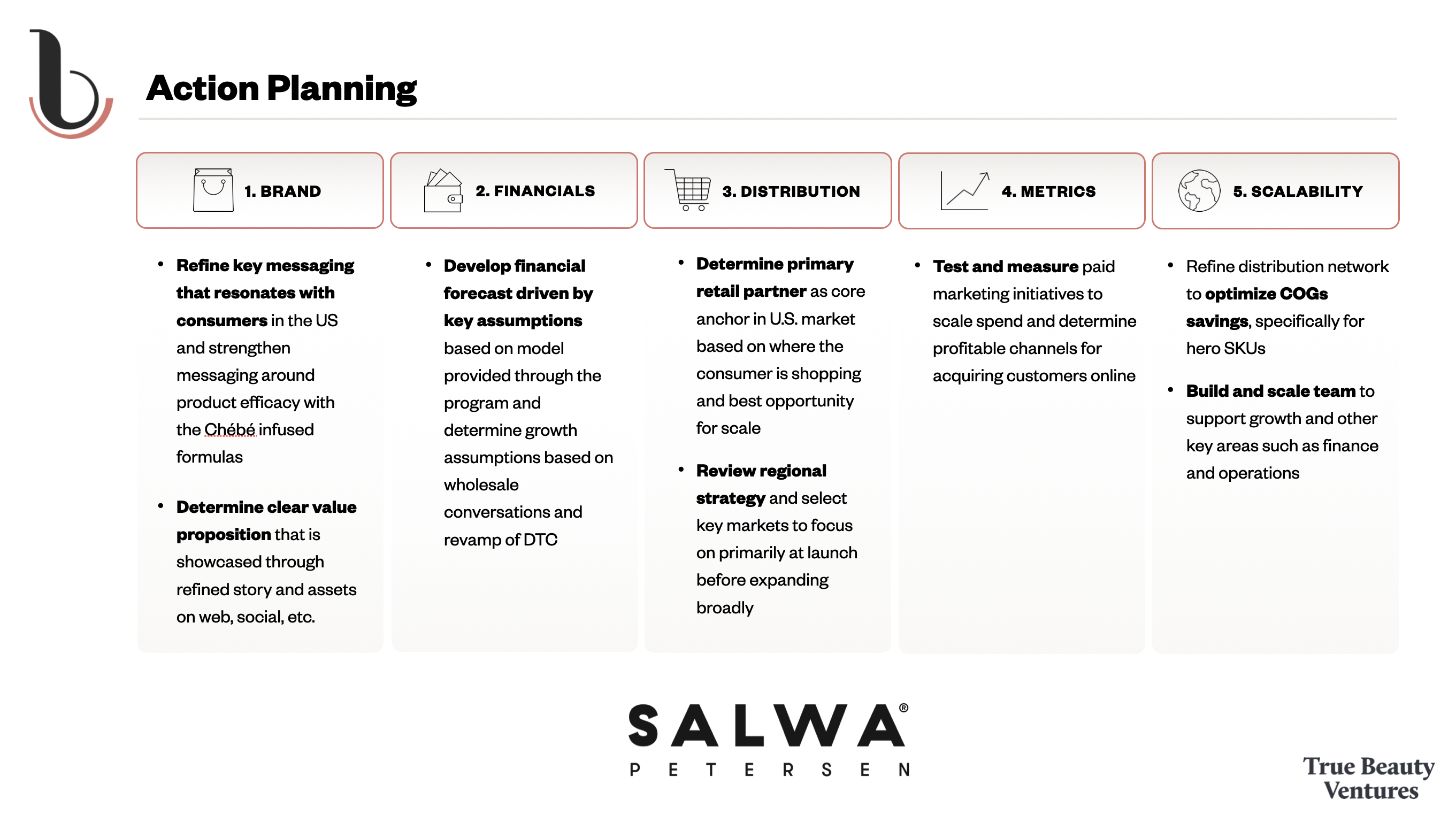

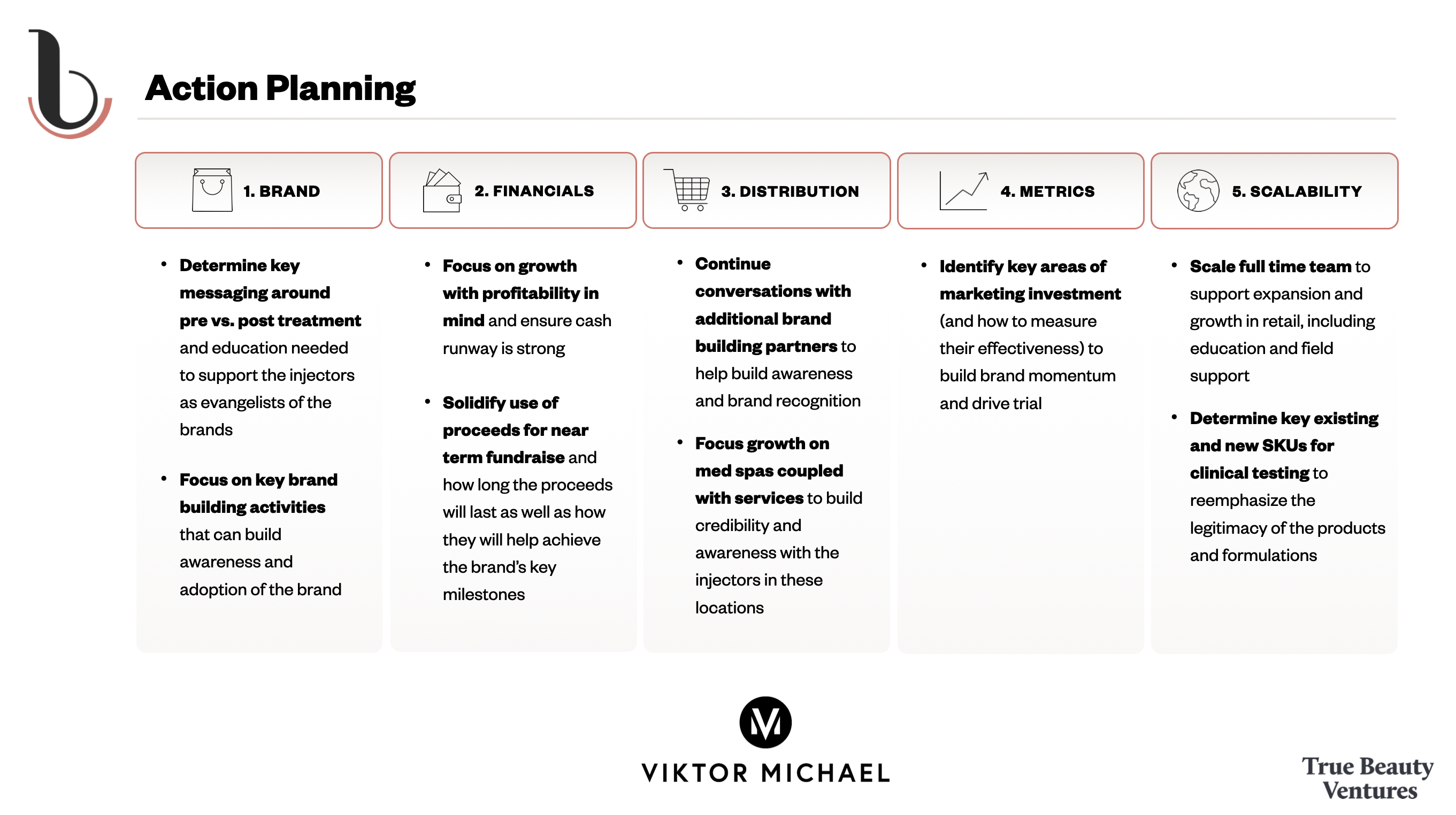

The founders who participated in the fourth cohort overall or second cohort of the 2023—DAMDAM co-founders Giselle Go and Philippe Terrien, Salwa Petersen founder and CEO Salwa Petersen and Viktor Michael co-founders Nadya Kozlova and Shay Sim—joined Nuñez and Gersten for the webinar. They went through the diagnostic process at the heart of Bridge Mentorship similar to the due diligence process brands go through when pursuing funding. The diagnostic process examines key business areas like brand positioning, finances, distribution and scalability. Once the process is completed, TBV creates action plans for the cohort participants to establish goals and measure progress.

Informed by Bridge Mentorship’s teachings, program alumni have achieved significant milestones. After launching at Ulta Beauty in 2022, Bridge Mentorship participant Youthforia secured seed funding from TBV and Willow Growth Partners. Another participant, Nopalera, raised $2.7 million in seed funding last year. Gersten said, “It’s so rewarding to see some of these past mentees go on and accomplish things and accomplish them so quickly.”

Below, we highlight top takeaways from the fourth cohort’s experience.

DAMDAM

- Year Launched: 2017

- Category: Skincare

- Positioning: Damdam is a Japanese clean skincare brand rooted in Japanese craftsmanship and time-honored plant ingredients. Embodying the Japanese approach to beauty that emphasizes quality, efficacy and respect for the skin, it has results-driven, planet-friendly formulations.

- Price Range: $38 to $68

- Hero Product: Mochi Mochi Luminous Cream

- Distribution: Sephora

DAMDAM’s partnership with Sephora made it stand out as a Bridge Mentorship applicant. The brand launched in 2017 and entered the retailer in 2021. “When we invest in brands, we generally look for either Sephora or Ulta distribution having been secured or on the verge of being secured,” said Gersten. “It usually happens later in the stage for most brands. So, DAMDAM’s ability to secure Sephora online distribution at such an early stage absolutely caught our eye.”

Still, as a Japanese company in the early stages of expansion in the United States, DAMDAM has had trouble translating its brand message outside of Japan. The brand’s participation in the Bridge Mentorship program clarified its path forward. Its Bridge Mentorship one-on-one sessions with TBV largely concentrated on refining storytelling and value proposition. Nuñez recounted, “We spent a lot of time figuring out who the brand markets to and what the brand means in Japan versus what it means here in the U.S.”

Go said, “It was just great validation from the True Beauty team to understand that there is a way to communicate our messaging without completely alienating our audience in the U.S. It was really about understanding how to communicate not just through social media, but also through personal events or real-life activations who we are as a brand.”

Salwa Petersen

- Year Launched: 2017

- Category: Haircare

- Positioning: Salwa Petersen is an award-winning, eco-conscious, clean, vegan, affordable, clinically proven textured haircare powered by the best of ancestral wisdom, nature, salon-grade performance and modern science. Grounded in the millennia-old Chébé ritual from Chad and infused with a proprietary extract of heirloom organic Chébé seed, it gives the luxury of modern textured haircare to everyone with curls, coils, kinks and waves.

- Price Range: $18 to $59

- Hero Product: Chébé du Tchad Hair Cream

- Distribution: DTC and indie beauty retailer Pretty Well Beauty

Salwa Petersen and TBV zeroed in on mapping out the brand’s distribution strategy during the program. Available on its website and at indie beauty retailer Pretty Well Beauty, the textured haircare brand is evaluating an anchor retailer that could best suit its masstige positioning.

“The reality is that textured haircare has been for the longest time in mass, so that’s where the customer is,” said Petersen. “We also know that prestige retailers are trying to attract that customer, too. Theoretically, we could play everywhere, food, drug, mass, professional and prestige. So, it’s very complex.”

Petersen underscored the importance of team building for her emerging brand. As a solo operator, she highlighted the difficulty of knowing how to make the right hires and when they should be made. Petersen said, “I actually want to thank True Beauty Ventures because we had a couple of operational emergencies, and some of the people they introduced me to really helped save the day.”

Viktor Michael

- Year Launched: 2023

- Category: Skincare

- Positioning: Viktor Michael is pioneering a new recovery care category, with conscious, clinical-grade formulas that are laser-focused on minimizing downtime associated with cosmetic injections. Infused with its patent-pending Injection Care Complex, its products are formulated to deliver pre- and post-treatment care and skin health maintenance in between injections.

- Price Range: $112 to $157

- Hero Product: Hidden Agenda Pre and Post Injection Care Serum

- Distribution: DTC, retail, spa and affiliate

As a young skincare brand looking to capitalize on the burgeoning post-injection category, Viktor Michael has multiple distribution options. Bridge Mentorship assisted it with nailing down its approach to retail.

“B2B is where we need to be,” said Kozlova, referring to professional distribution in the spa and doctors’ office channel. “That has been an incredible foundational change for us. You have to keep hitting this matrix of what actually works, how you connect with the customer and what’s going to be the most efficient way of doing it.”

Sim, her co-founder at Viktor Michael, agreed. “We’re going to be huge,” she said. “We know that we’re going to be able to tap into this injection space, but it was just taking those baby steps to really identify that major blueprint.”

Nuñez mentioned that brands wading into new categories have several levers they can pull to demonstrate their chances of commercial success. “It’s just a matter of showing investors that you have confidence in the path that you’re going to choose and how you’re going to build this category alongside your brand,” she said. “You have to do a really good job of articulating though because it may not be as obvious.”